Proactive Mortgage Management Works: Annual Review Leads to a $417,302 Benefit

As part of our ongoing due diligence process, each year we perform an Annual Review. This ensures that our clients remain in the mortgage program that best suits their needs.

During a recent Annual Review interview, we discovered that our client, who was 48 years of age, had no pension plan of significance other than a 401k. This was a life factor that was not evident when the original mortgage was written. In addition, market conditions had changed such that a more viable mortgage configuration made sense to address this personal need and also allow the client to accumulate wealth in the process. At the time of the Annual Review, his home was worth $650,000 and his mortgage balance was $100,000.

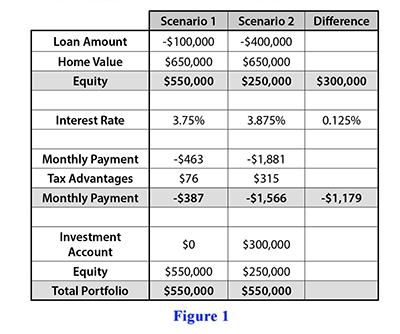

With all things considered, we recommended that he borrow $400,000 and take the $300,000 and invest it into either an annuity or a life insurance policy. This suggestion would allow him, at age 65 or older, to accumulate an asset that he could use to fund his retirement and build it while he is able to afford it. He would have to discuss the tax advantages of this action with an accountant as there may be some opportunity to make the interest deduction tax advantaged.

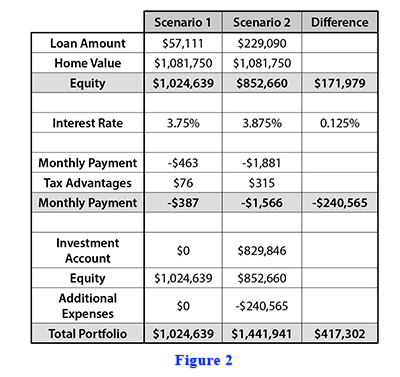

In Figure 1, Scenario 1 reflects him leaving the mortgage as it was at the time of the Review; Scenario 2 shows the results of taking the actions we recommended. We refinanced the house to a new 30-year fixed rate mortgage at 3.875%, and we invested the money at 6% with a competent financial planner. We also assumed a 3% rate of return on the growth in the value of the home. At age 65, 17 years later, we can see that the investment account has grown to $829,846 and the mortgage balances have been reduced to $57,711 and $229,090. After considering the additional payments that were made on the new $400,000 mortgage of $240,565, the client has accumulated a net investment account value of $417,302 after repayment of the existing mortgage balance (see Figure 2).

Let me take this a bit further. If we keep the $300,000 investment working for the full 30-year period, the investment value is projected to be $1,806,772, and the borrower would be 78 years old. This does not consider the value of the property, assuming he still remains there. In addition, if an insurance strategy is adopted, the future withdrawals can be taken out as a loan, and as such they would not be taxable as a 401k or IRA distribution would. Further, in the event of a untimely passing, the family would have a death benefit to maintain their legacy.

Our Annual Review Process

During a typical Annual Review, we consider the following questions:

- Is the current mortgage solution optimal given market conditions and available products?

- Is the mortgage solution a good fit for any current or anticipated life changes?

- Does the mortgage solution allow the client to achieve relevant wealth accumulation objectives?